US “Liberation Day” Tariffs and the Indian Construction Industry in 2025

The global economy in 2025 is undergoing transformative shifts, with nations reevaluating trade alliances, tariff strategies, and manufacturing priorities. Among the most consequential developments in recent months is the United States’ sweeping tariff overhaul, unofficially dubbed the “Liberation Day Tariffs.” This bold policy move has sent ripples across multiple industries worldwide, and India’s construction sector is among the most affected. As one of the pillars of the Indian economy, construction drives domestic growth while playing a crucial role in international trade through the export of building materials, engineering goods, and specialized technological services.

The Genesis of the “Liberation Day Tariffs”

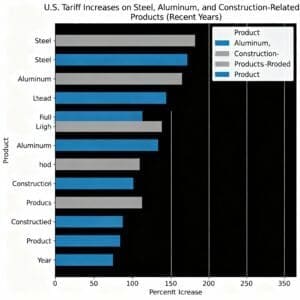

In April 2025, the U.S. government unveiled a comprehensive tariff regime aimed at reshaping global trade flows and promoting domestic manufacturing. This policy introduced a universal 10% baseline tariff, with higher country-specific duties ranging up to 25% or more on certain goods from India. Raw materials such as steel, aluminum, copper, as well as automotive parts, textiles, and other industrial products were particularly targeted. By July 2025, some tariffs escalated further, with steel and aluminum imports facing duties as high as 50%.

While the primary goal was to reduce dependence on Chinese imports, the global consequences were far-reaching. India, as a significant exporter of engineering goods, construction materials, and auto components, suddenly found itself in a precarious position. The new tariffs represented one of the most significant protectionist surges in decades, reminiscent of the pre-World War II era in terms of scope and impact.

Impact on India’s Construction Ecosystem

Supply Chain Vulnerabilities

India’s construction sector, contributing nearly 9% of the nation’s GDP, is the second-largest employer after agriculture. It spans residential housing, commercial complexes, and large-scale infrastructure projects such as highways, metro systems, and smart city initiatives. However, the industry relies heavily on imported raw materials, high-tech machinery, and green technologies, making it particularly susceptible to global trade disruptions.

Key inputs like steel and aluminum are essential for structural frameworks, while copper wiring and cabling are critical for electrical and telecommunications networks. Advanced machinery, including cranes, lifts, and tunnel-boring equipment, as well as sustainable technologies like solar panels and HVAC systems, further highlight the sector’s dependence on international markets. With tariff-induced price surges, construction companies have faced immediate challenges in budgeting and project planning.

Exports and Revenue Shocks

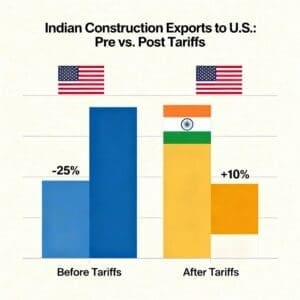

India’s exports of construction and engineering products to the U.S. amount to over $30 billion annually. Pipes, valves, structural steel components, electrical equipment, and plumbing systems form a substantial portion of this trade. With the introduction of a 25% effective duty beginning August 2025, the Engineering Export Promotion Council (EEPC) anticipates a shortfall of $12–15 billion in FY 2025–26.

The shock has affected manufacturers across the value chain, prompting reconsideration of production volumes, supplier contracts, and project timelines. Many exporters are now forced to explore alternative markets or negotiate pricing strategies to maintain competitiveness, while domestic projects face the dual challenge of rising input costs and supply uncertainty.

Rising Domestic Costs and Project Delays

Higher material costs are rippling through ongoing construction projects in India. Public infrastructure initiatives, which often operate under fixed budgets, have been particularly affected. States like Maharashtra, Tamil Nadu, and Telangana have reported delays in project timelines due to input cost inflation.

Housing projects, especially in Tier-1 cities like Mumbai, Bengaluru, and Delhi, are seeing escalated construction costs, putting pressure on affordable housing schemes. Large national infrastructure programs such as PM Gati Shakti and Bharatmala are revising their cost estimates, while contracts under the Hybrid Annuity Model (HAM) are being renegotiated to accommodate unforeseen price increases. Logistics have also been disrupted, with cargo rerouted through alternative ports and suppliers, increasing transportation costs by 8–12% and straining just-in-time inventory systems common in modular construction.

Government Response and Strategic Measures

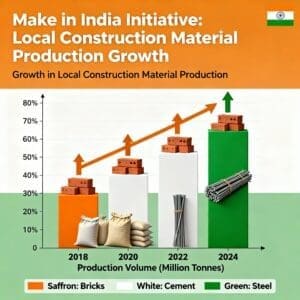

The Indian government has adopted a multi-pronged approach to mitigate the tariffs’ impact. Trade officials are lobbying for sector-specific exemptions, while support for local manufacturing has been bolstered through PLI (Production Linked Incentive) schemes for construction materials. Temporary relief on duties for critical imports from non-U.S. sources has been introduced, and approvals for public-private partnership (PPP) infrastructure projects are being fast-tracked.

These efforts are creating renewed opportunities for local manufacturers, especially SMEs producing pipes, fixtures, and machinery, who are ramping up production to meet demand. Government initiatives like Make in India and Atmanirbhar Bharat are gaining traction, encouraging construction firms to source materials domestically and fostering the growth of micro-industries in cement, paint, glass, and tiles.

Innovation and Adaptation in the Industry

The tariff shock has also spurred innovation. Startups and research institutions are exploring alternatives to traditional construction materials, including geopolymer concrete, bamboo-based composites, and 3D-printed structural components. Companies are adopting AI and blockchain solutions for better cost forecasting and supply chain resilience, while e-procurement portals are enabling faster identification of local suppliers.

Developers are experimenting with new funding models and hedging strategies to protect against cost volatility. Simultaneously, exporters are exploring emerging international markets in Africa (Kenya, Nigeria), Southeast Asia (Vietnam, Indonesia), and the Middle East (UAE, Saudi Arabia) to reduce reliance on the U.S. market. These measures indicate a sector-wide shift toward resilience, sustainability, and strategic diversification.

Turning Challenges into Opportunities

While the short-term effects of the 2025 U.S. tariffs—higher costs, slower growth, and uncertain exports—are challenging, they have also created a moment of reflection and strategic adaptation. Indian companies now face a defining opportunity to transform adversity into growth by embracing local innovation, digital transformation, and diversified trade strategies.

By investing in homegrown materials, optimizing supply chains, and exploring alternative markets, the construction sector can emerge leaner, more self-reliant, and resilient. The tariffs, while disruptive, have accelerated the adoption of smarter construction practices, catalyzed innovation, and renewed focus on domestic capabilities.

Conclusion

The 2025 U.S. “Liberation Day Tariffs” have undeniably disrupted India’s construction sector, highlighting vulnerabilities in supply chains, cost structures, and export strategies. Yet, the industry’s response demonstrates remarkable adaptability. With government support, technological innovation, and a renewed focus on domestic manufacturing, the sector is poised not just to survive but to thrive in the face of global uncertainty.

India’s construction industry stands at a crossroads—its path forward will be defined by its ability to turn challenges into opportunities, embrace innovation, and build a more resilient and self-sufficient ecosystem for the years ahead.